Innovative Team Collaboration: 3 Tools for Seamless Project Management

Read More

Measuring NPS in the fintech industry serves as an indicator of customer satisfaction and loyalty. Fintech companies that make a real effort to up their customer experience game and boost their NPS scores are setting the stage for solid and long-lasting connections with their customers. It’s the secret sauce for success in the cutthroat fintech market – happy customers, happy business!

But here’s where it gets a bit tricky. The intricate dance between complex financial products, regulatory constraints, and the constant demand for seamless user experiences makes it hard to gauge customer satisfaction.

For fintech software development companies, there’s a double duty – not only do they need to offer top-notch financial services, but they also have to keep their customer’s data safe. Regular surveys can sometimes mess with this delicate balance, risking the privacy of data. Striking the right chord between getting feedback and keeping things locked down is a real head-scratcher.

But, how to do that? Let’s find out!

Over the years of working with many Fintech companies, I have found that personalized unique links offer a cutting-edge solution to the challenges posed by traditional survey methods.

These links, facilitated by advanced NPS software, act as secret doors to gather feedback without putting data at risk. Unlike generic surveys, these links are tailor-made for individual customers, ensuring a personalized and secure feedback collection process.

I have personally experienced some amazing benefits of these links while working with Fintech companies. Some of them are:

Explore SurveySensum To Boost Your NPS

Now, let’s dive into a real-time fintech case study on how it improved its NPS with these customized links.

A major Fintech company in India was facing the challenge of keeping its customer’s personal information secure while gathering feedback from them. So, in a bid to ensure data security, all the while measuring and improving their NPS, they collaborated with SurveySensum.

The company had a large number of customers with sensitive personal data and they wanted to send NPS surveys to their customers in a bid to improve its NPS in Fintech. But their major concern was with the leak of sensitive personal data of its customers. If their customers can’t trust them with their personal data then it doesn’t reflect good on the company’s reputation.

Now, in order to send surveys to them they were brainstorming solutions to keep the PII of these customers safe and secure.

So, what’s the solution here? – Personalized Unique Survey Links.

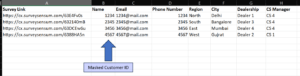

Every company maintains a customer ID for each customer. This ID is mostly a randomly generated numeric string which is used as a primary key. The client made use of this numeric string and imported the data corresponding to each ID preventing the need for accessing PII outside the system.

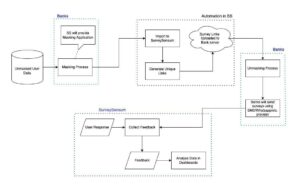

Here’s how they executed this process:

This led to the use of Personalised Unique Links, a feature that creates a unique and personalized link for every single customer. In SurveySensum’s survey builder, they used the option to create unique survey links of the same survey for different customers.

Here’s how unique survey links were created with SurveySensum:

And the best part about this process is that SurveySensum has no knowledge of who the customer is: no Name or Email or Phone Number. This way, no PII data leaves the internal systems.

Here’s how customer ID is masked, keeping important data secure.

Once the responses are in, the client tracks the Customer ID (or masked ID) and all data associated with the customer that can help with the analysis and ultimately with closing the feedback loop with customers.

Launch WhatsApp Surveys

They had an existing WhatsApp account which was already used for their support and general updates, so the customers were familiar with the number. Now, with the help of SurveySensum’s WhatsApp survey feature, they used this WhatsApp number to share these unique survey links.

Happy with the data integrity and safety, they started collecting transactional NPS feedback within the first 2 months with the help of unique survey links and API integrations using WhatsApp.

By identifying the most common issues on different touchpoints and closing the loop effectively with the help of instant detractor alerts, the client increases its NPS score by +15 points.

This extended case study underscores the power of sending personalized unique survey links to gather and improve NPS in Fintech companies. The success achieved in ensuring data safety, improving the NPS score, and enhancing customer satisfaction validates the potential for similar strategies across the Fintech sector.