Voice of the Customer (VoC) metrics are relationship data points that give organizations direct communications from the customer with revealing facts about their customer experience. It’s easy to see the value in this direct customer feedback. But you’re not maximizing that value if you’re not using the VoC metrics to change your organization, to create an organizational climate of learning about the customer experience, and to inform future renewal forecasts.

Several key VoC metrics are instrumental in informing companies. These metrics include net promoter scores (NPS), customer satisfaction (CSAT), and customer effort scores (CES). Within the industry, NPS continues to be a key metric used to evaluate the customer’s willingness to renew as well as gauge the overall health of the relationship. However, some organizations are not aware that there is a difference between relationship surveys and transactional surveys.

NPS is a survey that best defines the relationship between the supplier and the customer. Some organizations use it as a transactional survey that one would normally see in a support services or professional services organization. A transactional survey, by definition, has a start and stop, like the beginning and end of a project or a support case. For the purposes of this blog, we will focus on relationship surveys and using NPS as a mechanism to collect that insight. I will highlight three steps that could improve your insight into relationship data and help you gather more value from your NPS surveys.

Step 1 – Target the Right Respondents

When using Net Promoter Scores as a “relationship survey,” the survey should be sent to key customer contacts that hold important affiliations. Far too often, surveys are sent to the masses without much thought about who will be invited to participate. Just because a customer came to your website, downloaded a white paper nine months ago, and has had no further interactions with your company does not mean they should be sent an NPS survey.

As a practitioner of Customer Success, I have seen this happen. Not only does surveying the wrong people skew the data, it creates chaos, confusion, and unnecessary work for the team that is trying to interpret the data.

Let’s be smart about this and identify in your tools, the three respondents who should receive the survey. At a minimum, the survey should go to the executive sponsor, business owner, and key contact(s). In some organizations, these three positions could be the same person. Using your best judgment and listening to the recommendations from the Customer Success team will be vital in identifying the key customer contacts who have the strongest knowledge of the inner-workings of your organization.

The input you receive from these key customer contacts will have greater meaning and value because they will have greater insights, awareness, and recommendations that will have a level of credibility, certainty, and truth that a customer that had a two-second interaction could never provide. Be intentional in who receives your NPS survey so that you can glean the type of data that will help your organization learn and grow from the feedback received.

Step 2 – Creating NPS Survey Clarity

Surveys come in many shapes and sizes, from scoring criteria on a scale of 1-10 where 1 is good and on another scale where 10 is good. Additionally, in a global economy, some respondents have different interpretations of what score is considered good based on the culture and location. Many companies regretfully fail to remember that the NPS Survey, along with the Customer Effort Survey, or Customer Satisfaction Survey, may be delivered to a global market with different interpretations of the scoring system. As a result, it becomes imperative to make sure that any ambiguity is removed from your survey. Your survey must be crystal clear to provide quality feedback.

In every business that I have ever worked as a Customer Success executive, I have seen NPS survey results that had a score of “1” with a customer comment field that stated, “my experience with your organization is the best I have ever worked with in my career.” Do you see the problem here? The notes section just saved the company because it clarified why they got a terrible score of 1 instead of 10.

Just a friendly reminder that NPS scores start with a scale of 0 to 10,not 1-10 as many organizations mistakenly document in their surveys. Even though your team provides clear directions and outlines that a score of 0 is bad and a score of 10 is good, the customer is rushed and does not pay attention to written instructions.

Customers mistakenly marking a low score when trying to provide a positive score is a universal problem that we hear about from TSIA members. The problem is very easy to clear up by leveraging the technology platforms that deliver the survey.

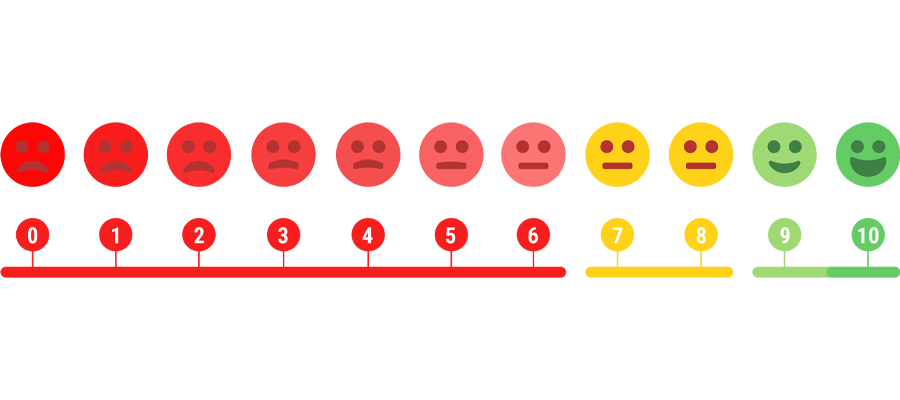

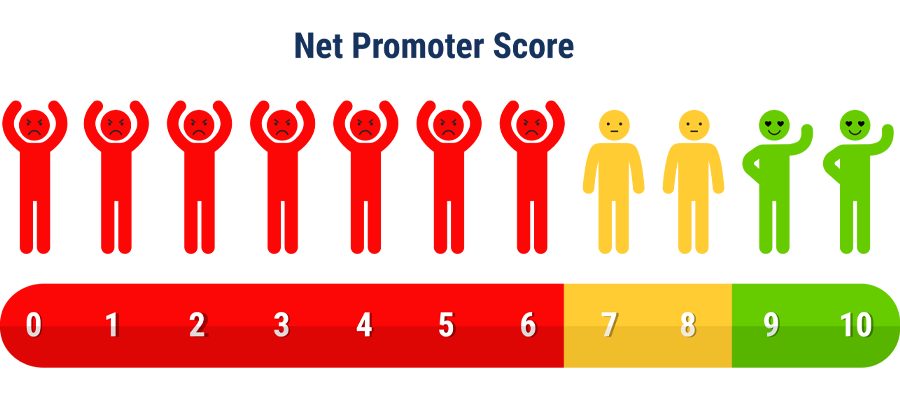

If you are using a survey delivery system like Qualtrics or leveraging your company’s marketing system such as Marketo, most of these systems give you the ability to incorporate emojis or icons to show what the NPS scoring system looks like from 0-10. Doing a quick internet search of “net promoter score icons” will give you a plethora of visual aids that remove any uncertainty. Just be mindful of copyright restrictions when selecting icons or emojis.

Figure 1 and Figure 2 below both contain the most commonly used icons that will show 0-6 in RED with a mad or unhappy face or a person with their arms crossed. Scores with 7-8 will be in YELLOW and typically show a neutral face or a person that is pivoting in one direction or another. And lastly, scores 9-10 will be GREEN with a smiling face or a person waving their hands in excitement or holding a loudspeaker. Pick the artist rendition that is best for you and the geography that will be receiving your next batch of net promoter scores.

By removing any uncertainty in your organization's scoring, it is less likely your data will be skewed from a rushed individual who did not take the time to read the instructions. The efficiency of your organization will increase because the survey team will not be spending time reaching out to the customer to validate or verify the incorrect score, nor will they engage their executive team to ask what should be done with the scores that were most likely intended to be positive but marked negatively.

Creating certainty and removing ambiguity is the easiest of the three steps to change quickly. It creates customer feedback results that are without any doubt the customer’s truth.

FIGURE 1:

FIGURE 2:

Step 3 – Create an Executive Oversight Committee

Net Promoter Score is the leading ‘relationship’ metric used by 76% of customer success organizations, based on insights gathered from our own TSIA Customer Success Benchmark. Incorporating NPS is a fantastic first step to better understand, from an “outside-in” perspective, how the customer views your organization and to glean the overall health of the relationship.

The NPS score and feedback reveal the customer’s willingness, or lack thereof, to promote your business with their contact networks. It is also a leading indicator of whether the customer will renew their contract with an organization.

Additionally, NPS can be an important metric to use when building a customer health score. More than half of organizations are building health scores. These scores help with predictive capabilities for renewals. For this blog, NPS will focus on organizational level reporting and not on the individual contributor level.

The challenge most organizations experience after deploying the NPS survey is “Now what do I do with this information?” Author Fred Reichheld is the creator of NPS and authored two books, The Ultimate Question and The Ultimate Question 2.0. One of the more important chapters discusses the importance of creating an executive oversight committee with key leaders who have oversight and ownership of the departments in which customer feedback is directed.

Requesting a C-Level executive to chair the executive oversight committee is key and demonstrates the importance of this committee to the organization. In many organizations, the daily Chairmanship responsibility may be delegated to the Chief Customer Officer (CCO) or the Vice President of Customer Success (VPCS).

The next step, according to Reichheld, is to ensure that the customer information is brought forward in understandable feedback to the department owners so they can build a mitigation plan and communicate the plan back to the customer. In many organizations, the senior executives will bring in the lowest level of management with direct responsibility to address and fix the issue where the problems have been identified.

Building a team that includes all customer-facing departments and departments that have a direct responsibility to resolve issues presented by the customer is key. It is important to give this committee a name such as a Keeping Organizational Outcomes, Retention, Renewals, References, and Reputation Excellent (KORE) Committee, Executive Oversight Committee, NPS Committee, or any other name that communicates across your organization a level of importance on the customer experience.

Then establish a meeting frequency to review customer data. Realistically, a monthly meeting gives the teams more time to address issues and bring the mitigation plan back for the next meeting.

It is unlikely that an executive or staff member will want to respond to the same problem again in future meetings. Typically, you will see departments expend a strong effort to resolve customer issues so that their departments are not in the spotlight for creating a negative customer experience.

Closed-loop feedback is paramount in the relationship and more successful organizations will make sure that they provide a response to customers via some form of communication so that the customer does not feel like they have wasted their time in communicating with your company. This step communicates from the highest level of your organization the importance of the customer’s feedback and the need to address and mitigate those issues at the lowest levels. The next step then is to make sure that business incentives are also aligned.

Conclusion

In summary, targeting the right contacts, removing uncertainty in the NPS surveys, and creating an executive oversight committee are three steps to creating a richer customer environment. They are instrumental in moving the value needle forward in a quick 18-month period. These three steps to glean more insightful value from net promoter scores are relatively simple yet overlooked process steps that create greater efficiencies, reduce uncertainties, and create an environment of learning from meaningful NPS data that will improve the overall customer experience.

The next step after improving the value of your net promoter scores is to start using that information to help build your customer health scores so that your organization can start building predictable health scores that reveal probable renewal, expansion, and business outcomes.

A great case study was presented at the TSIA Interact conference in October 2020, when Qlik shared a presentation on “How a Successful VoC Program Will Put the Customer at the Center of Your Success!” As we transition to 2021, more member presentations like this will be accessible at our TSIA Interact virtual conference to be held May 4-6, 2021. Learn more about our spring virtual conference.