Happy customers are key to sustaining a thriving business, and achieving this depends greatly on providing exceptional customer service. To surpass their expectations, you need to stay ahead of the game. Fortunately, in partnership with ACT (Advanced Call Center Technologies), we have just released our CX Leaders Trends & Insights: 2022 Corporate Edition report which is aimed at empowering brands with the knowledge and insights needed to accomplish this.

By unlocking valuable patterns and insights, our report will help you keep your customers satisfied and your business thriving.

This latest volume of research contains trending and new data built around the experiences and perspectives of 111 senior CX leaders. It includes content on a variety of topics including CX Technology, Touchpoints, CX Strategies, Workforces, Workplaces, and a special section devoted to comparing CX Leaders Trends & Insights Consumer and Corporate Edition results. And like previous editions, this new research is enriched with the powerful Practitioner’s Perspectives insights — snapshot analysis from accomplished CX leaders representing top brands, each targeting a specific research result.

You can read and download the full CX Leaders Trends & Insights: 2022 Corporate Edition report here.

An Industry Emboldened by Optimism

The CX Leaders Trends & Insights: 2022 Corporate Edition survey conducted brought forth encouraging results, indicating a boost in confidence within the industry. According to the survey, more CX leaders believe they are satisfying their customer’s needs and expectations than at any other time since 2018.

The CX Leaders Trends & Insights: 2022 Corporate Edition survey conducted brought forth encouraging results, indicating a boost in confidence within the industry. According to the survey, more CX leaders believe they are satisfying their customer’s needs and expectations than at any other time since 2018.

Although there were indications of a slowdown in growth, particularly in terms of headcounts, growth remained a top priority for 2022. The shift to work-from-home (WFH) is viewed as a positive change within the industry, with agents’ remote performance improving steadily. Many organizations have adopted hybrid models that have proven to be highly productive.

However, the industry still faces a few challenges. These include hiring and retention, obsolete technology systems, and increasing financial pressures.

- Seventy-four percent of CX leaders indicated their organizations are already taking significant or modest actions to address economic uncertainties

- Eighty-six percent of CX leaders felt their organizations were generally meeting the customer care needs and expectations of customers

- SMS/Text remains the most highly planned solution in the short-to-near-term, followed closely by Chatbot/Virtual Assistant, Video Chat, and Kiosks

- Seventy-seven percent of survey respondents describe the shift to WFH as having a “Very Positive” or “Somewhat Positive” impact on meeting customer needs and expectations, up from 66% in 2021

- Thirty-eight percent of companies measuring the entire customer experience across all channels

- Only 31% of CX leaders are “Very Satisfied” or “Satisfied” with the CX technology stack

Workforces and Workplaces

In addition to the changes in headcount, the survey reveals a strong and positive sentiment among CX leaders in 2022. Despite facing tumultuous times over the last three years, they see numerous benefits arising from the situation, particularly the shift to working from home.

- The growth of combined operational head counts (both In-House and Outsourced FTEs) appeared to have slowed in 2022, with fewer brands indicating increasing head counts (46% in 2022 versus 58% in 2021), and more brands indicating decreasing head counts (19% in 2022 versus 13% in 2021) (page 20).

- Seventy-seven percent of survey respondents describe the shift to WFH as having a “Very Positive” or “Somewhat Positive” impact on meeting customer needs and expectations, up from 66% in 2021 (page 27).

- The top areas where CX leaders are most interested in improving agent performance include Problem-Solving/Product Knowledge, Proficiency/Speed to Resolution, Communication (Speaking and Listening), and CSAT Scores/Quality (page 24) Forty-seven percent of CX leaders visited a partner site in 2022, up from 16% in 2021 (page 26).

Touchpoints: Channels Measurements & Performance Preferences & Initiatives

SMS/Text and Chatbots are the top solutions that companies plan to invest in in the future. However, before investing in these channels, it is crucial for brands to thoroughly understand whether such solutions align with the expectations and desires of their specific customer base. Brands need to recalibrate their priorities and understand what success looks like from the customer’s perspective, which should begin with accessibility, ease, and effectiveness. Proper monitoring is equally important to validate the value of these efforts.

- Across organizations, roughly three-fourths of all contact volume occurs across just two solutions: Phone and Email; but consumers are migrating, slowly (page 34).

- SMS/Text remains the most highly planned solution in the short-to-near-term, followed closely by Chatbot/Virtual Assistant, Video Chat, and Kiosks (page 36).

- Thirty-eight percent of companies measuring the entire customer experience across all channels (page 38) The average reported Resolution Rate of “Chatbot/Virtual Assistant” improved 19 points year-over-year, from 37% to 56% (page 40).

Strategies, Program Data, and Loyalty Strategies

In the Conclusions section of the Workforce and Workplaces report (page 30), the industry’s optimism for 2022 was highlighted, which is reflected in several of the results presented in this section.

One notable result is that more CX leaders believe their organizations are meeting customers’ needs and expectations than at any point since 2018. However, challenges persist, including outdated processes, tools, and legacy systems that continue to hinder progress, as well as the well-known labor force challenges.

- Eighty-six percent of survey respondents feel their organization is generally meeting customer needs and expectations — the highest result since 2018, and the second highest ever (page 51).

- Legacy Systems/Processes/Tools is the single biggest challenge (34%) facing CX leaders, followed by Labor Force/Staffing/Agent Performance (27%) (page 51).

- The three KPIs that garner the most attention at the majority of institutions include CSAT/VoC, FCR, and NPS (page 58).

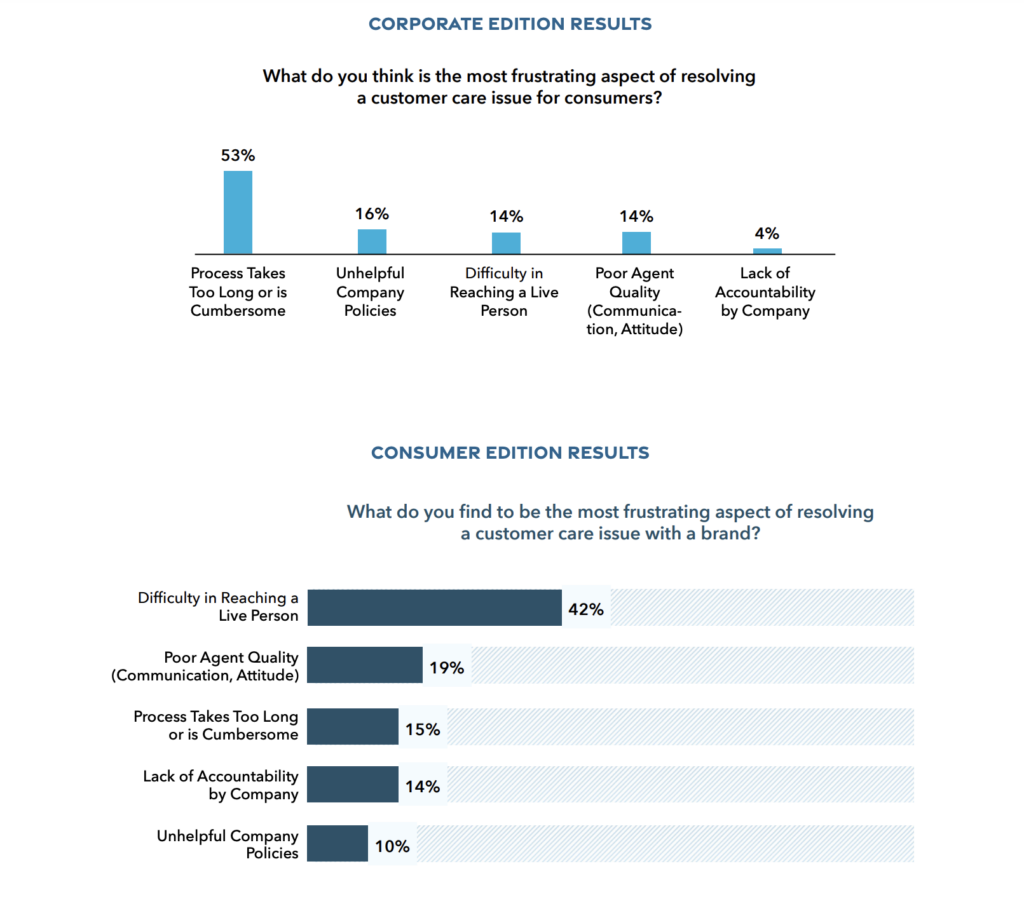

- Fifty-three percent of CX leaders think consumers are most frustrated with the customer care process being too long or cumbersome, yet the largest percentage of consumers (42%) point to the difficulty in reaching a live person (page 63).

Artificial Intelligence

Investing in CX technology is crucial for CX organizations, but it’s concerning that CX leaders are dissatisfied with their current CX tech stacks.

- Only 31% of CX leaders are “Very Satisfied” or “Satisfied” with their organization’s current CX technology stack, while 38% are “Very Dissatisfied or dissatisfied” (page 68).

- Text/Speech Analytics, AI, and Agent-Assist Technology were the top three areas of support technology investment in 2022 (page 70).

- Only 60% of organizations have specific plans for increasing the resolution capabilities of unassisted solutions (page 76).

- The percentage of organizations using an AI-powered solution for “improving the customer experience” grew for the third straight year (page 75).

Corporate vs. Consumer Comparisons

In this section, we present a comparison between the results presented in this report and those published in the October 2022 CX Leaders Trends & Insights Consumer Edition report. The latter report was based on data collected during August, July, and September in 2022.

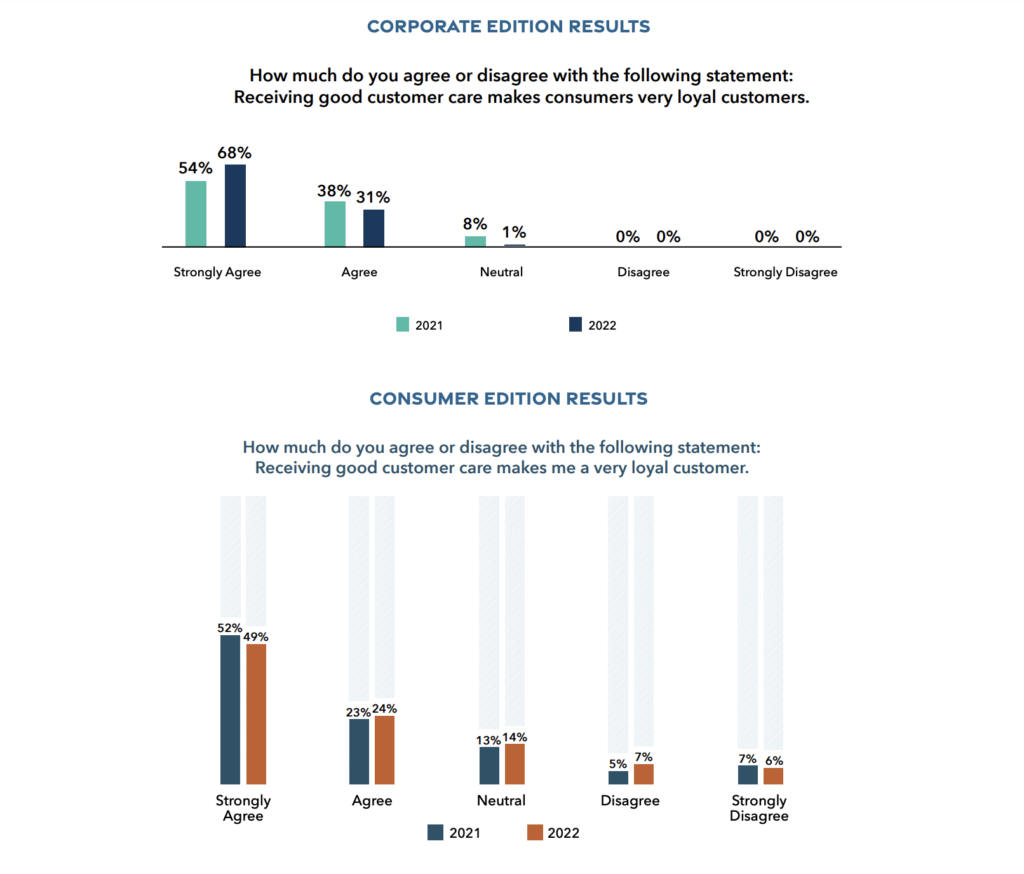

Good Care Leads to Loyalty

A vast majority of CX leaders (99%) believe that providing good customer care has a direct correlation to customer loyalty. Additionally, a substantial 73% of consumers share the same sentiment. When executed effectively, customer care can be a definitive and reassuring encounter between a consumer and a brand.

In light of budgetary constraints and renewed evaluations of the significance of CX within a larger business context, CX leaders must be ready to argue that loyalty is a crucial factor in achieving business success, and any allocation of resources towards CX is tantamount to investing in fostering customer loyalty.

Most Frustrating

The following results reveal that CX leaders adopt a practical approach to fulfilling consumer desires, emphasizing process, policy, and prompt conflict resolution. Nevertheless, customers continue to prioritize access to a human representative, as well as the representative’s competence. This may be advantageous for CX leaders since it implies that their brands are excelling in terms of process and policy. Conversely, consumers anticipate being able to contact a live person on demand, and once they do, they expect a friendly demeanor and excellent communication abilities.

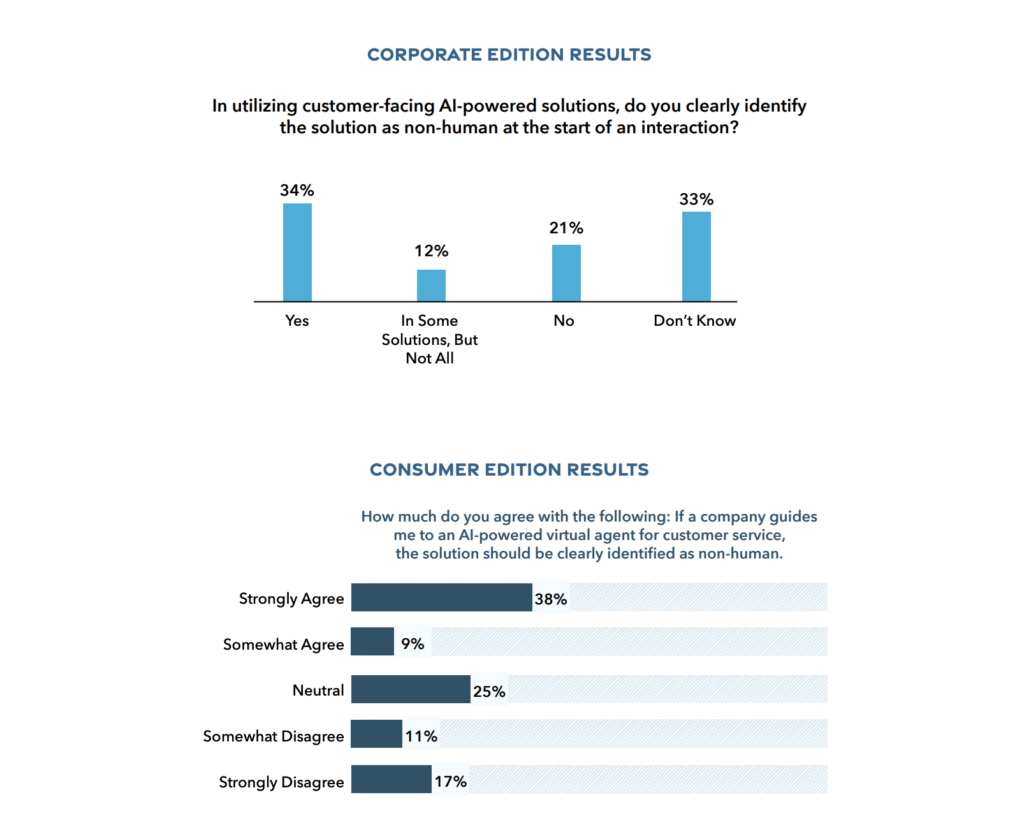

Identifying Non-Humans

The findings on consumer attitudes toward the identification of AI-powered solutions varied significantly based on the demographic being surveyed. While only 47% of consumers agreed that non-human solutions should be clearly labeled (consistent with the responses of CX leaders), the results differed depending on age groups. The majority of respondents in the 18 to 24 age bracket had a neutral stance at 41%, followed by 23% strongly disagreeing.

In contrast, over half of those aged between 55 to 64 years agreed that non-human solutions should be identified as such. These results underscore the need for CX leaders to understand their customers, especially in terms of demographics and their openness to embracing innovative technologies and solutions.

You can read and download the full CX Leaders Trends & Insights: 2022 Corporate Edition report here.